The Order books system has been the crown jewel of predominant exchanges. There has been a great debate between orderbooks vs automated market maker systems to determine the more efficient, liquid, transparent, and secure systems when it comes to cryptocurrency exchanges.

There are some misconceptions individuals make while making distinctions in orderbook and automated market maker systems. To determine the better we need to first understand how each of these systems works and which use cases are best suited for the implementation of these systems.

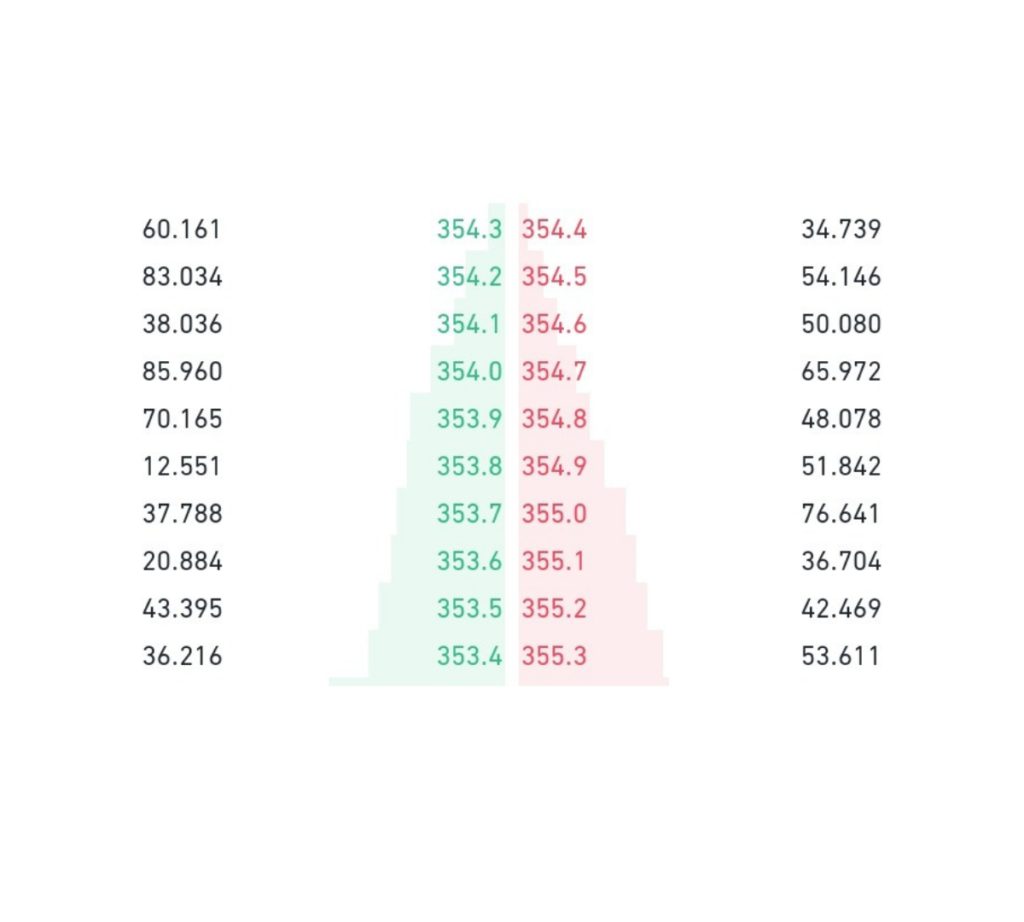

The Order book system is the only orthodox method of trading involving two parties the buyer and the seller. This system is based on an order-driven mechanism. All of the available orders for your desired trade and their prices are listed on a table called the order book.

The order matching scenario can be exact or partial. If someone has executed a bigger but exact opposite order than you, the order book will fill their partial order and your entire order as it is the inverse of your trade.

For example, If a trader wants to sell 100 KMD for 100 USDT the system will first look for the exact opposite trade.

If the system is unable to find an exact opposite trade it will look for opposite trades but with more volume and partially fill that trade. In the worst-case scenario, the system will search for two or smaller trades and fill them entirely.

To simplify, the orders in the orderbook generate liquidity, the more orders the more liquidity. Every day traders can also be beneficiaries in this system providing liquidity for assets with lower supply and higher demands.

Many third parties are also providing liquidity and earning interest from the platform. Traders or institutions with cryptocurrency reserves lend their assets to exchanges on longer terms for interests.

This can also result in a price monopoly where whales can control the price of an asset, only selling at their own biddings. They can short any assets out of the market at any time. Liquidity can also vary if an asset has more selling orders than buying orders by a big margin.

Orderbook system is not only used in cryptocurrency trading but also in stock exchanges and foreign exchanges. NASDAQ the world's largest stock exchange (by volume) uses an order book style of trading called continuous books.

Nasdaq has contracted different third-party firms that are called designated market makers. The job of a market maker is to provide liquidity to the exchange and earn commission on each trade called a maker fee.

The biggest centralized exchanges in the world such as Binance also use modified order book systems. Liquidity providers are trivial for Binance due to natural order load, but Binance has complete control over your coins like most centralized exchanges and you are not aware of your private keys.

The automated market maker is an autonomous trading model introduced by the progressing Decentralized finance world. This method is a subset of the order book system developed in a competent manner for cryptocurrency exchanges.

An automated market maker is a decentralized system of trade where trades are directly executed from a smart contract that is wrapped by a liquidity pool of tokens/coins. These pools can be shared by liquidity providers to earn interest and fees like a maker in the order book system.

This pool is locked in a smart contract which determines the fees for the exchange. If a trader wants to exchange 100 USDT for KMD, AMM will search for the KMD pool and execute the trade with the calculated fee. This is called wallet-to-wallet trading where no third party is involved.

Automated market makers create a trustless environment by creating a wallet-to-wallet trading system. The assets are released from a smart contract address to the taker's address directly and no Centralized exchange or middle man is needed.

Pancakeswap is a great example of how an Automated market maker system works. Pancakeswap has also provided new security to the contributors in the liquidity pool in the form of Liquidity Pool Tokens.

The goal of Amm is to provide more liquidity to the DEFI world averse to the traditional trading system for once. This liquidity allows traders to convert one asset to another without changing its market price. The execution price is the final price of the asset traded.

This is possible due to smart contracts which are the only piece of code mediating between the pool of assets and the traders. These smart contracts determine the price, the fees, and the execution of the trade. Most of the smart contracts backing Automated market makers are made open-source and audited by third parties to earn more trust by users.

Atomic DEX is a client-side, multi-coin, cross-platform wallet developed by the Komodo platform. Atomic DEX uses the order book system but makes the exchanges trustless and wallet to wallet.

The private keys are stored client-side like most of the wallets are doing these days to maintain user privacy. The trades or atomic swaps are executed directly from the maker and takers' wallets. Read the article on atomic dex trading steps.

This means that there are no centralized parties involved the trading is real-time from wallet to wallet and unlike centralized exchanges, the wallets or the private keys are not stored by Atomic Dex nevertheless.

| Automated Market Maker | Orderbook |

| Exchange relies on a smart contract with pools of tokens to do trading. | Exchange is dependent on the real-time liquidity of the order book. |

| Fixed trading with locked liquidity in smart contracts. | Real-time trading with variable liquidity according to the volume of buying traders or selling trades. |

| Makers can not manipulate the market or smart contracts. | Makers might be able to manipulate or short the market pulling liquidity (trust system). |

| Makers can face impermanent losses. | Impermanent losses are negligible |

| The current market makers are mostly available for Ethereum or EVM-capable assets such as Binance smart chain assets. | Orderbook system is available for almost all assets on centralized and decentralized exchanges (liquidities can vary for up popular assets). |