Synthetix is a DEX and an asset issuance protocol. It is ideal for trading cryptocurrencies, commodities, and sFIATs (Synth FIATs). It can be considered an emerging alternative and competitor of the 0x relay.

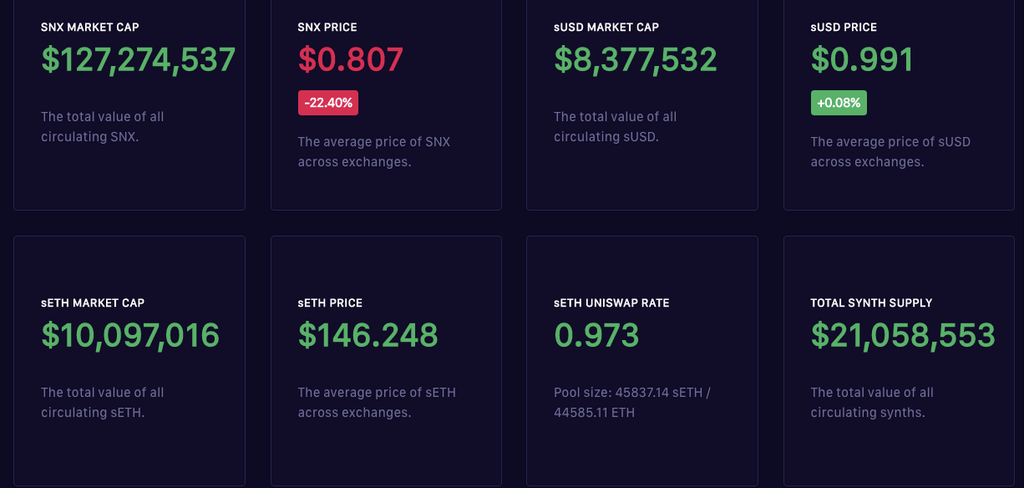

It works on top of the ethereum blockchain and allows infinite liquidity limits with over 20 different synths available to trade with. The market cap of SNX coin is $181 million, with an average price of $0.8 at the time of writing.

There are two kinds of tokens in the Synthetix Network. SNX is the Synthetix network token and synthetic assets, known as Synths. For example, sBTC is a synth. SNX works as collateral for synths to provide liquidity to the market.

Synth is a purpose-specific smart contract, it is used as a wrapper for DEX trades, just like the 0x relay. However, the SNX is a functional token but is standardized for liquidity and staking purposes.

This algorithm is so designed to wrap ETH, USDT, BTC, etc into its own smart contract which excludes counterparties. The main purpose is to interconnect the ethereum blockchain with other stable and major coins like BTC, LTC, etc.

The market cap of sETH, sUSDT, etc has different market caps and values for what original ETH and USDT have. The commodities are wrapped around synth contracts which make BTC into sBTC.

Synthetix platform has 2 major products:

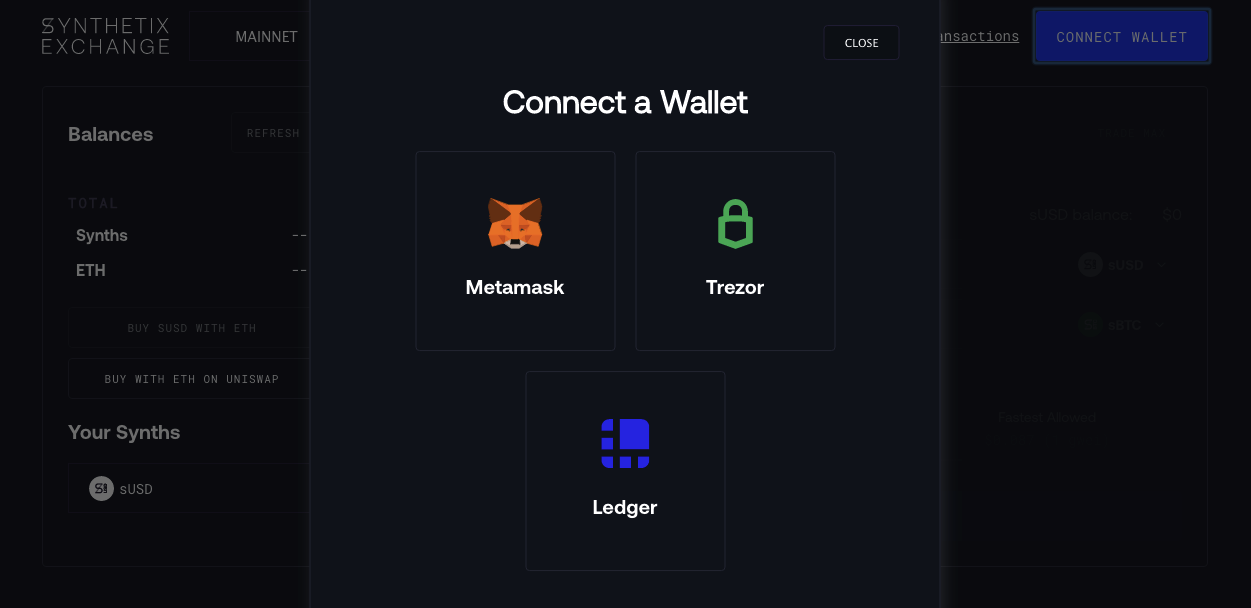

To work with the exchange you need to unlock funds using MetaMask as a browser wallet. Synthetix only works with MetaMask as a browser wallet. Other options are Ledger and Trezor, both are hardware wallets.

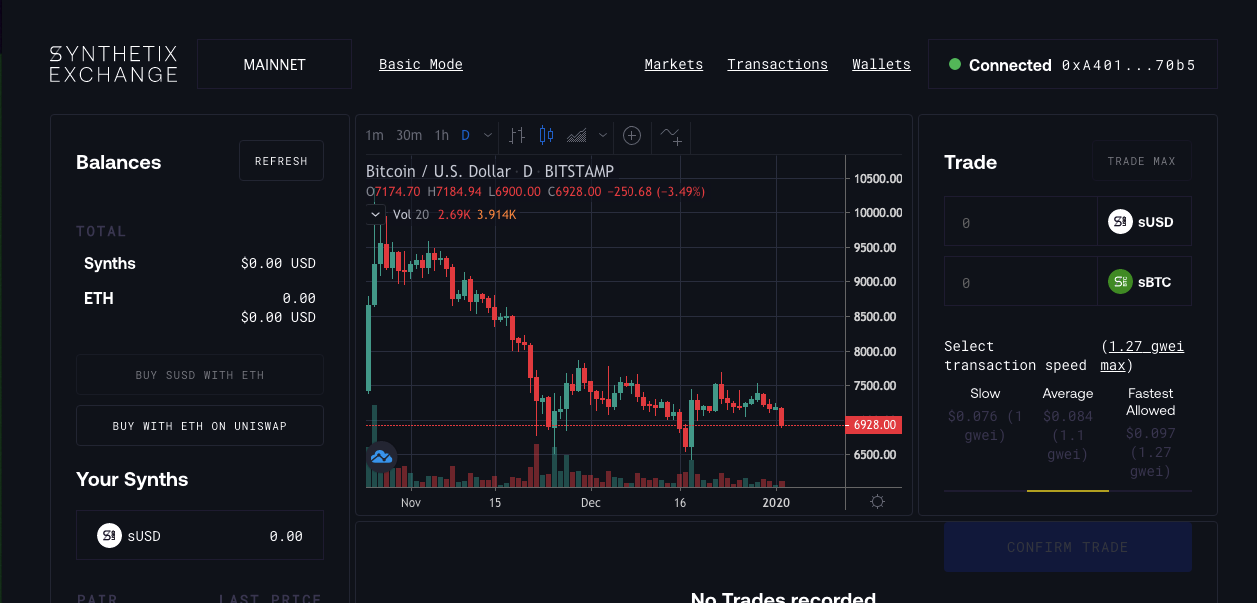

Once you have successfully connected your desired wallet, trading view charts will be active. TradingView API is the most trusted and accurate historical and real-time data-providing API in the market.

Trading is easy on synthetix, depending on your experience you can switch between basic mode and pro mode. TradingView works on pro mode.

There are no limits and waiting periods when trading with Synthetix. The P2P trading algorithm executes trade faster and easier, without order books.

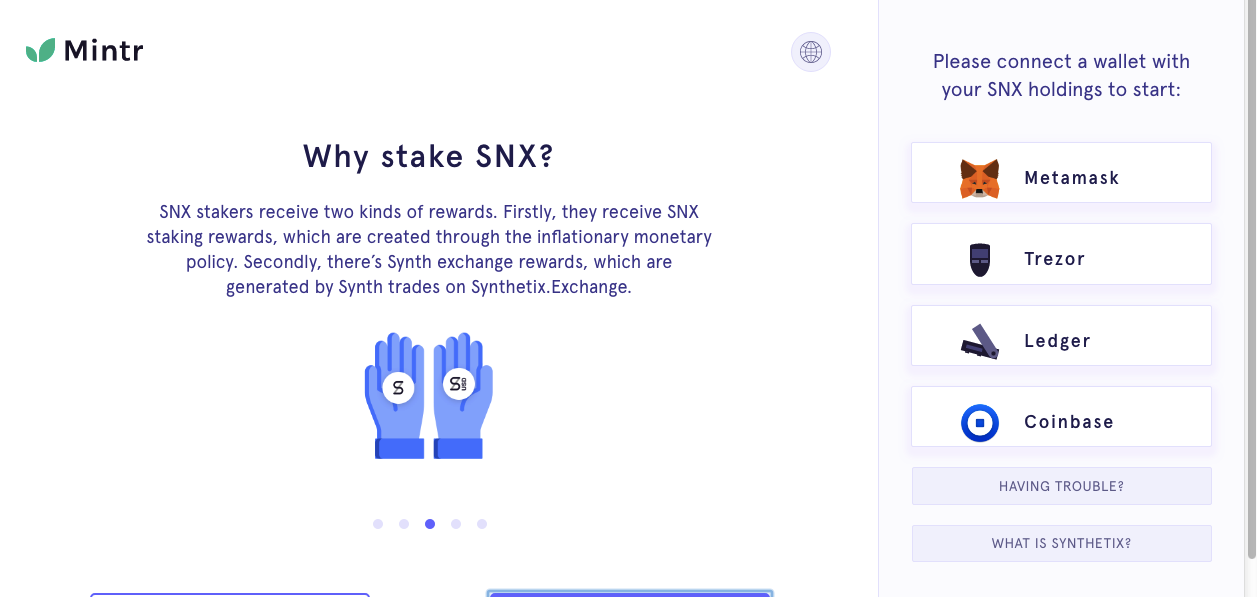

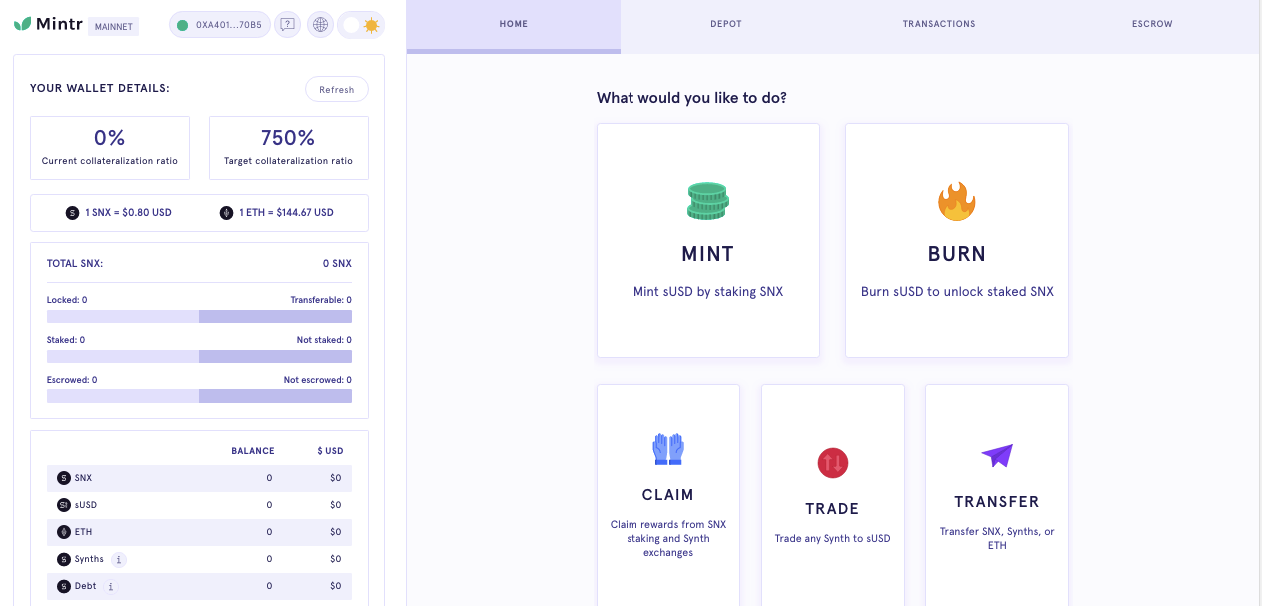

Mintr is the trading dashboard for users staking SNX tokens. Users can mint synths against SNX, staking the system and providing liquidity to the DEX. All Synth trades on DEX generate fees that are distributed to SNX holders, rewarding them for staking the system.

Collateralization is like securing a loan that users provide in form of their SNX tokens. They receive SNX staking rewards, which are created through the inflationary monetary policy defined by synthetix on their official white paper.

Secondly, there are Synth exchange rewards, which are generated by Synth trades on the DEX. To unlock the escrowed or staked SNX you can burn synths back into SNX tokens, allowing you to transfer your non-escrowed SNX.

The collateralization rate is standard for every stakeholder. It is considered optimal for small and large stakeholders to avoid rate fluctuations. “ A high collateralization ratio helps synths get approved for trades because it reduces SNX lenders risk”.

According to the official lite paper, this ratio can be maintained easily by minting SNX if the ratio is high, and burning SNX if the ratio gets lower than 750.

The team consists of experienced engineers, blockchain and finance enthusiasts. The support, however, is available via an active and spreading community on discord.