The Komodo team has some alpha testing consensus rules that were initially researched in 2019 to support collateralized stablecoin issuance, synthetic prices, and debt positions. This story comes from Forbes who extracted some great Antara Composer material. Background info on the tech supporting these solutions follows.

The first step in producing a suitable oracle for DeFi is building an oracle that is decentralized, not simply a trusted feed. The decentralized oracle enables all participants to enter into the oracle feed publishing portion of the system. Technical information about the price feed oracles used in a Komodo solution can be found in 2019 week 14 blockchain development update article, Komodo also produced another piece about the oracle problem and smart contracts.

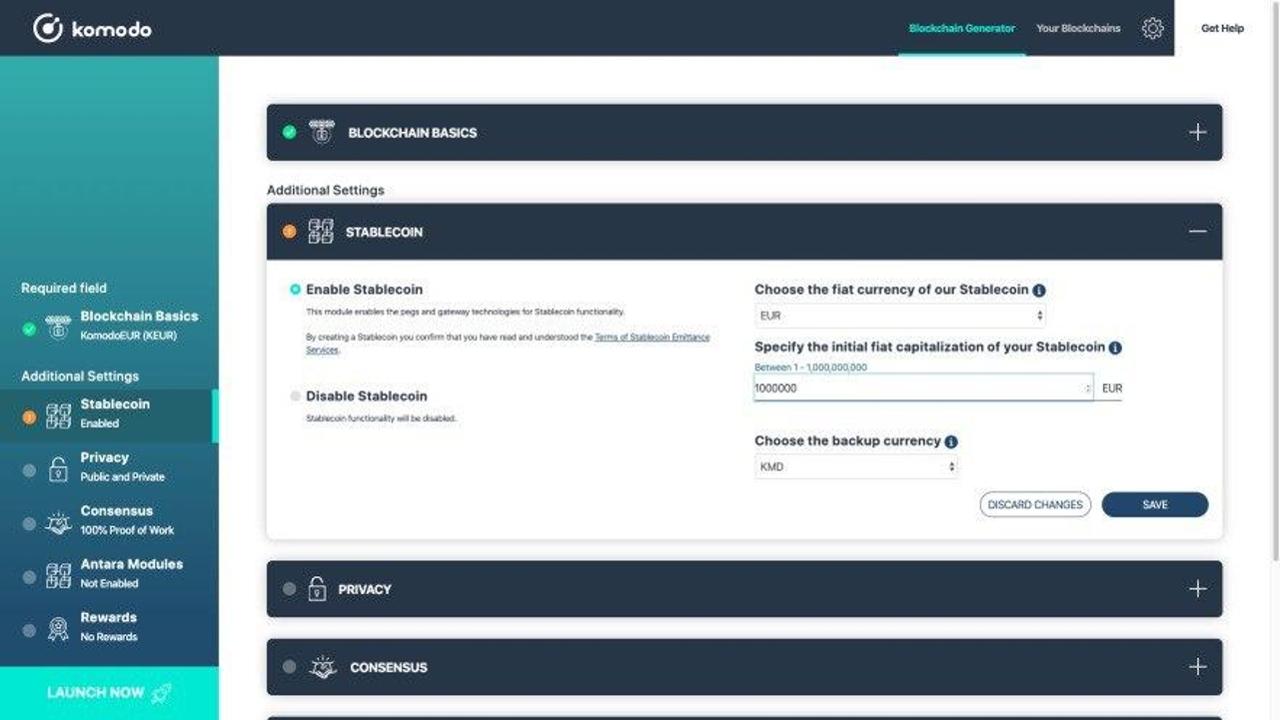

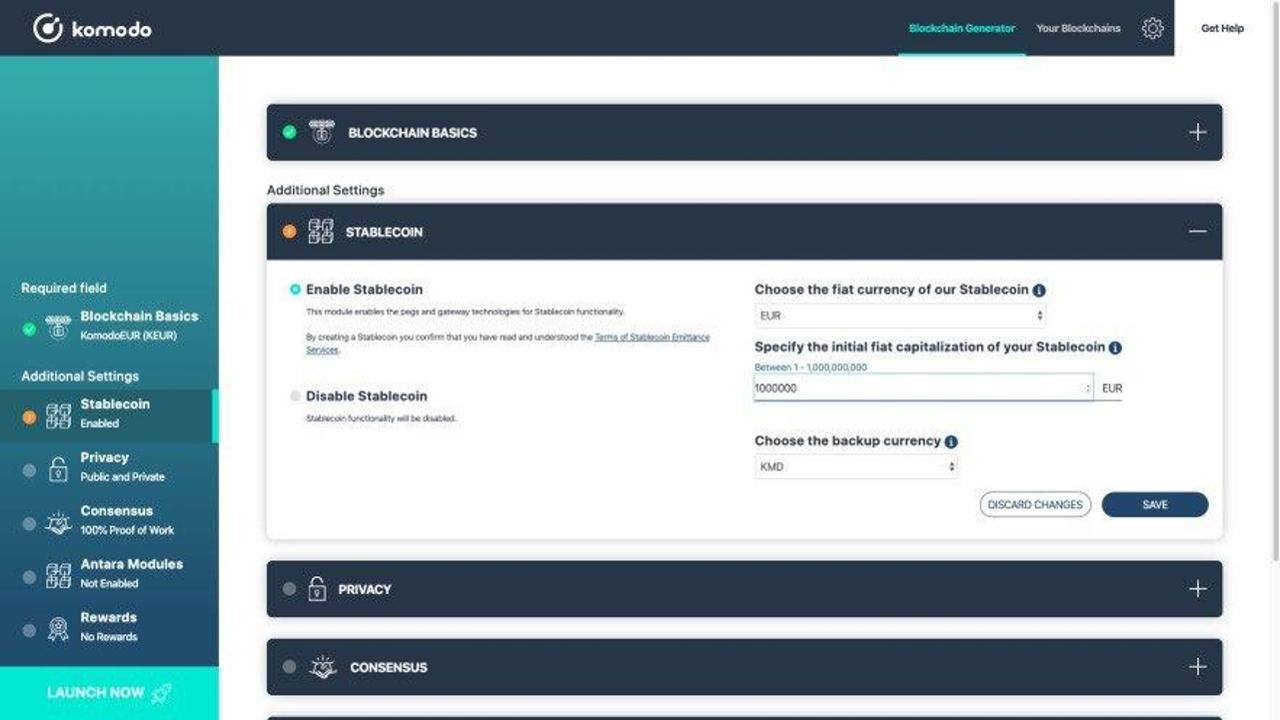

Once the decentralized oracle is available to the smart chain network, making use of the price data to make blockchain enforced positions becomes possible. Using pegs to form a collateralized debt position and synthetic prices is then available as new decentralized fintech products. This article from 2019 week 16 blockchain development update describes how any price feed data whether it is forex, crypto or stocks can be used with DeFi.

An example from Komodo team @gcharang in discord says:

Basically, any asset(could be an index/basket) whose price can be calculated is available as a stable coin. It just needs a separate chain. The peg on each chain can also be collateralized by multiple assets.

Examples of what is possible:

This podcast comes from the Ethereum DeFi space where synthetix & chainlink collaborate on creating their building blocks. We have written about synthetix on this website.