Collateral in DEFI is similar to traditional finance. While acquiring a loan a borrower goes to a lender for a certain amount of funds. The lender agrees to provide a loan once they both agree on the interest rate, this rate is based on the amount and the time of repayment.

The lender asks for the security of his loan by taking something of value from the borrower. The valuable asset that is being kept for security against the loan is known as collateral. They both agree that in case of failure of payment the ownership of the collateral is transferable for recovery.

The value of the collateral is more than the amount of the loan most of the time. The collateral allows the lender to guarantee the safety of funds if the borrower is insolvent. Sometimes in the case of insolvency, the collateral recovers both the original value and interest rate for a loan.

Lending in Defi is similar to traditional finance but the type of collateral is different. In traditional finance, collateral can be provided with assets like property, cars, gold, stocks, etc. In DEFI lending if you borrow a cryptocurrency you have to provide another cryptocurrency against it as collateral, this is known as collateralize lending.

For example, John is the lender and Mike is the borrower. John agrees to provide mike with $1000 worth of Ethereum against collateral that is 150% more than the lending amount. They both agree on a repayment time of 30 days with an interest rate of 10% above the amount.

This means that Mike has to pay $1100 to John within 30 days. If Mike defaults on the payment his collateral will liquidate to cover losses. This financial operation is automatically run through a smart contract. Different lending platforms have different smart contracts. The smart contract is written to lock the collateral release them if the borrower is able to repay the loan.

The biggest issue is over-collateralization. This means that the borrower will often default loan as the locked collateral is more than the actual loan amount. This means borrowers can lose their private keys or the smart contracts that hold their collateral can be hacked.

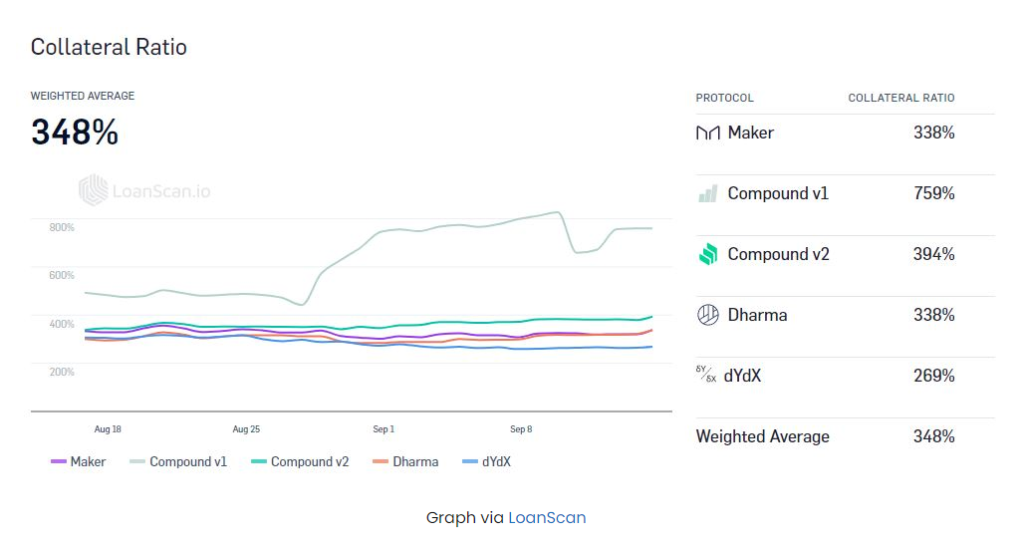

Over-collateralization is associated with impermanent loss to ignore losses. To ensure no future losses most platforms have really high collateral ratios for nonstable coins. For example, if your collateral is $150 Ethereum for $100 DAI and the value of Ethereum drops below $150 it will result in a penalty. To ignore these most platforms have an average collateral ratio of over 300%.

This collateral ratio is really huge and discouraging for borrowers. This can be ignored if the borrower collateralizes stable coins, they are less likely to see a price drop. The interest rates associated with stable coins are also less compared to major cryptocurrencies.