The Atomic Swaps market works on makers and takers trading. In this method, people who create orders are called makers, and those who fill those orders are takers. The order book is updated instantly when an order is made or matched.

This maker and taker model is different from what is defined in the finance and stock market world. The order orders made are added to the order book and orders taken are removed from the order book if they reach full limits/liquidity.

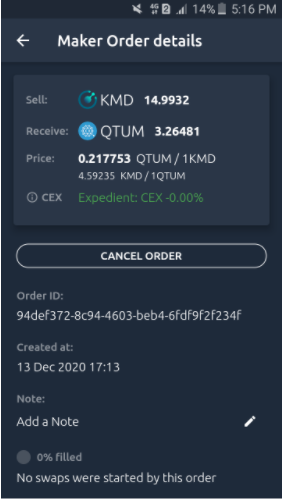

Makers are regarded as traders who provide liquidity to the market by creating orders at an off-set market price or at prices/quotes that are not already available in the orderbook. Makers in AtomicDEX don’t pay any fees and can set a custom price for peculiar orders.

This means that a maker can make good profit while trading if they think an orderbook has a low liquidity for a particular swap or exchange between two assets. On the contrary this means holding your coins for a specific period of time until an order is matched.

Market takers are traders who remove liquidity from the market by filling an order and taking an asset off the orderbooks. When working with AtomicDEX takers pay a maximum of 0.15% fees. An arbitrary opinion and analysis might suggest that takers in the cryptocurrency world aren’t usually looking for profits, instead they just swap their assets.

Takers can also make profit by only filling orders with the lowest liquidity or demand as usually these orders have a higher profit ratio and lesser chances or being filled. In these orders would usually have to pay less and get more.

Liquidity refers to the speed and capacities of an exchange when converting one cryptocurrency to another. Popular trading pairs tend to have a higher liquidity rate. This is mainly due to more orders being made and more takers rush to fill these orders.

In AtomicDEX liquidity is provided by traders and users only as it has an aim to make a transparent and decentralized exchange with no authoritarian involvement.

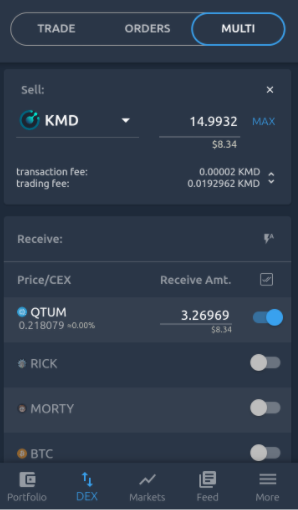

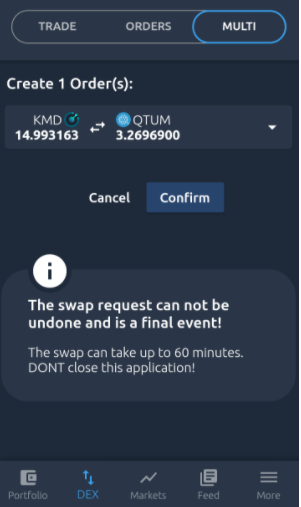

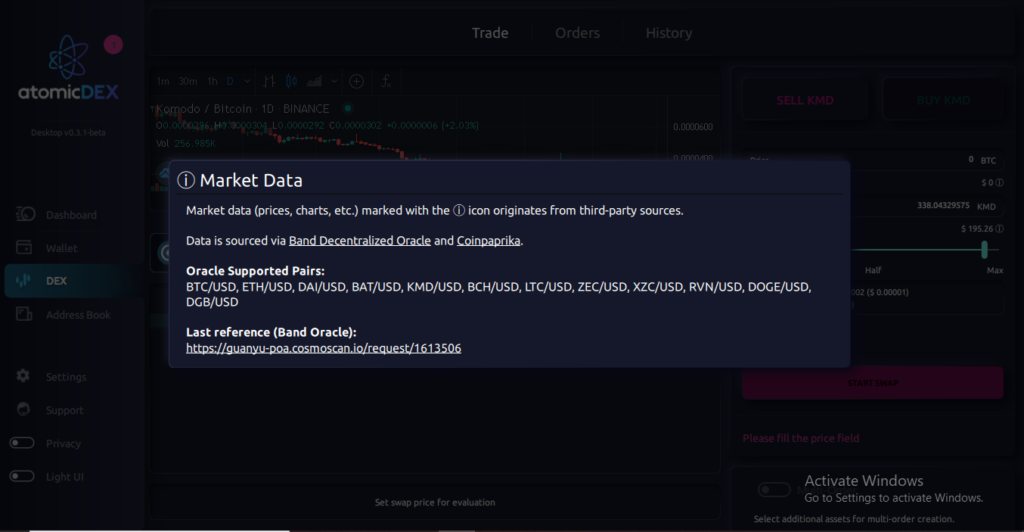

Creating an order on AtomicDEX is as easy as it’s told. Let’s go through the process of making an order (A pictorial representation).