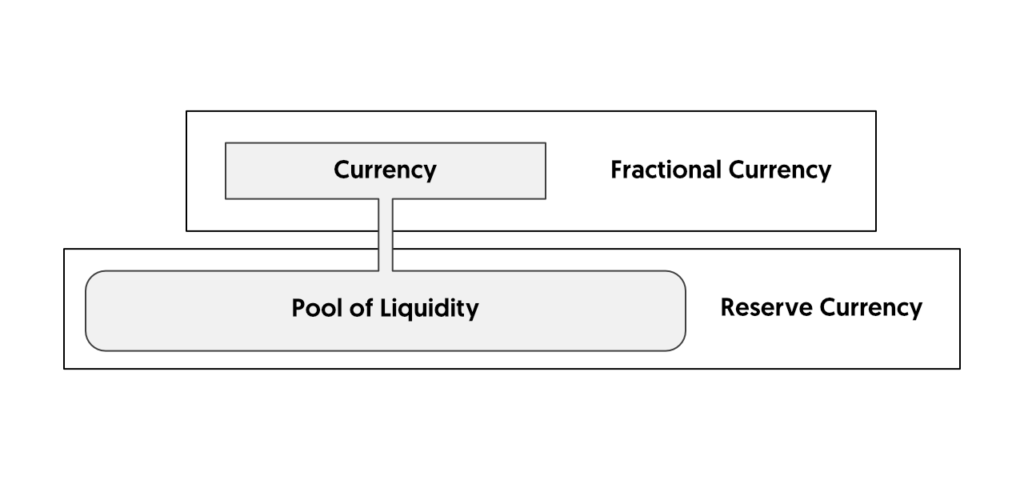

Verus blockchain is designed to create a bridge between verus and other chains for blockchain interoperability. This will be possible by crowd-driven reserve pools backed by fractional and reserve currencies.

These fractional currencies will be backed by reserve currencies or the original cryptocurrency. A bridge will be developed between verus and other blockchains. This bridge will than have a reserve pool with a pegged token/smart contract backed by original asset pool.

The public blockchain as a service (PBAAS) allows users to develop UTXO/smart-contracts with built-in connectivity and liquidity. All of this without programming. It is in the development stage and the testnet is a display of capabilities.

In short, a user doesn’t acquire the fractional currency but converts through the fractional currency to a reserve currency. This means that traders convert one reserve currency to another reserve currency.

For example, someone develops a fractional currency with liquidity or a reserve pool of DAI and VERUS. Let's call the fractional currency FDAI for the sake of argument. Now if someone wants to convert vrsc to dai, the algorithm will naturally fetch a fractional currency with DAI liquidity.

This FDAI will be available on the verus multi-verse with a public liquidity pool for anyone willing to take orders. This seems similar to pegged tokens on the Ethereum blockchain, but without programming and with public-provided liquidity.

Users who contribute by providing liquidity to the blockchain get rewards in conversion fees. Anyone who converts their assets pays a 0.025% transaction fee. This transaction fee will be added automatically to the reserve pool and accessible by the provider.