Venus Protocol is an automated protocol designed to bring a complete decentralized lending and credit system onto Binance Smart Chain. Venus declares itself a money market and stable coin platform built on top of the Binance Smart Chain. Venus can be compared with Aave or Maker of Binance Smart chain.

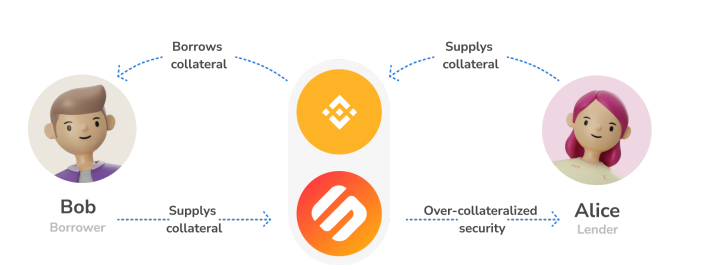

Venus enables users to earn interest on their assets by supplying cryptocurrencies as collateral to the network. These tokens are then borrowed by the process of collateralization. This ensures both safety and incentive to users and the network.

Venus aims to solve all the problems and remove the involvement of traditional finance in the DEFI world. They have developed features that are considered unconventional for most DEFI platforms. This excites a larger demographic towards Venus.

Venus enables the world's first decentralized stable coin, VAI. This coin is built on Binance Smart Chain, backed by a basket of stable coins and crypto assets rather than actual US dollars. This ensures that it is completely decentralized and no monopoly exists in their protocol.

A lot of stable coins are actually backed by US dollars which actually brings FIAT into the play. This process is stable as FIAT currencies are a lot more stable as compared to cryptocurrencies, but somehow eliminates the core concept of cryptocurrencies which is being decentralized.

The decision-making on most DEFI platforms is considered biased while there are stakeholders and private equity firms in play. These adversities are technically making them heavily centralized.

Venus utilizes the Binance Smart chain for fast, low-cost transactions. This overcomes the conventional problem faced by the Ethereum blockchain, which is the heavy fees and slower transactions.

Users can supply cryptocurrencies and stable coins and earn a variable APY for providing liquidity to the protocol. The liquidity provided is secured by over-collateralized assets locked by borrowers. The interest rate, however, is not fixed but based on demand and supply of the particular assets, this can bring some ease for borrowers with lower collateral rates.

The block earns the interest for lending assets and can be used as collateral to borrow assets or to mint stable coins. These stable coins can be used on a platform called Swipe. This platform provides virtual and physical debit cards backed by cryptocurrencies. You can spend on more than 60 million locations worldwide.

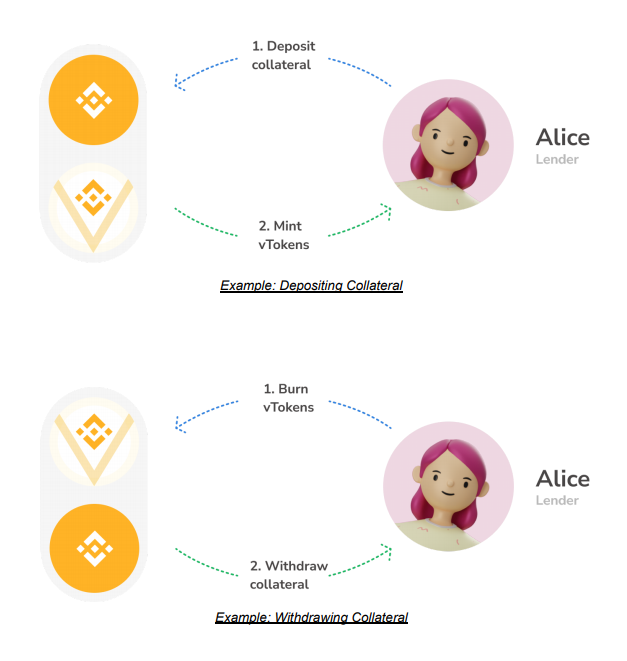

The protocol-created pegged assets when collateral is supplied are called vTokens. Users that supply their cryptocurrency Venus receive a vToken. If you provide Venus BTC you will get vBTC token in return. vTokens are created and implemented by Governance processes and voted by Venus Token holders.

These vTokens can be stored in cold storage and can be transferred to other users.

The Venus Protocol is governed by the Venus Token (XVS), which is designed to be a “fair launch” cryptocurrency. There are no founder, team, or developer allocations, and the XVS can only be earned through the Binance Launch Pool project or through providing liquidity to the protocol.

The source code for the platform is public including the smart contract and can be found on GitHub. Venus has been audited by CertiK with an overall score of 93%. You can read the full report here.

Venus is overall a great platform with still a lot to come. The zero FIAT involvement, protocol governance, better rates, and algorithms allow venus to embrace the definition of decentralized in DEFI.